I had someone that I reported up to at one time that explained the career cycle as a series of steps. The basic idea is that you spend some time at a given level, you learn and assimilate, then you move up to the next step and the process repeats itself. The basic idea is that there are a virtually unlimited number of steps and that everyone moves from step to step at a different pace. Each step encompasses a variety of factors, all of which are unique to the person, step, situation, and company. Sometimes people walk right up and hit their virtual ceiling while others stagnate at the same step year after year. Others still will find themselves rising quickly only to level out at some point.

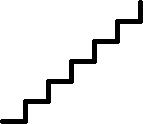

Steps – moving regularly up through a career

The basic idea behind his metaphor is that you should always be moving up. If you look at a given employee (or yourself) and find that the person has spent a long time at a given step, then something is wrong. If a person is stalled out at a step they may need guidance – or perhaps they are just in the wrong position.

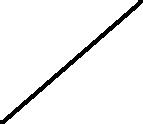

Slants – moving very quickly up through a career

Throughout my career I have seen three kinds of steppers. There are the people who follow the “norm” and step from one step to the next, regularly advancing their career. There are others who seem destined for the top and move almost along a straight line they move up the steps so quickly. Yet others skyrocket at first, only to find themselves slowing down the closer they get to the top. While many would pose that the regular steps are the most common, I would say that the quick ascent, followed by step is.

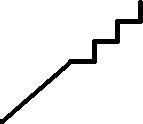

Slants and Steps – moving up quickly, to a point, only to level out

The reason is actually quite simple: people will generally excel when they are undertasked and not challenged. Almost everyone falls into this category as they search out the job that is right for them. So what does this mean? It means that if you see yourself, or others, following a trend of very rapid career growth, perhaps they would be better utilized in a different position. This different position doesn’t necessarily mean that it has to be higher in the reporting chain, but simply more challenging and interesting to the individual charted.